There’s nothing creative about time tracking, invoicing and managing business expenses. But when you’re a working artist, accounting chores are part of the job. FreshBooks artist management software for accounting helps you get your numbers right so you can spend less time on paperwork and more time creating.

How do small businesses use accounting?

The answer is not easy, but there are some fundamental principles that work for art and accounting as well. Accounting is a “type” of art; it is an art that helps investors, traders, and so forth, make better decisions by providing the information that investors need. It is one of the most important tools that helps investors make money and protect their money. By studying the definition alone, we learned some important concepts in accounting.

What is the approximate value of your cash savings and other investments?

- Sales tax is another consideration, particularly for galleries and dealers.

- Discuss with your partners what you found and how you want to fix it.

- Each piece should have a comprehensive record that includes high-quality images, detailed descriptions, and any relevant historical data.

- FreshBooks accounting software for artists offers a mobile app that allows you to easily connect with your clients and take care of your accounting anywhere – from coffee shop to mountain top.

For example, hiring an additional employee is qualitative information with no financial character. However, the payment of salaries, acquisition of an office building, sale of goods, etc. are recorded because they involve financial value. Accounting is also considered a science because it is a body of knowledge. However, accounting is not an exact science since the rules and principles are constantly changing (improved by standard-setting bodies). A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Would you prefer to work with a financial professional remotely or in-person?

Continuing with a system deficiency that you identified, developing a change and not doing anything about it will relegate you to remaining as you are, or leaning backward rather than pushing forward. Without good systems and compliance, most businesses will have as many systems as there are people. Think about any successful franchise, with McDonald’s, Subway and Jersey Mike’s coming quickly to mind. None of these could be successful without a system that is followed by everyone everywhere every time. And the people working there follow the system because they have to.

- The fee structure is straightforward and transparent, so there’s no guessing involved.

- Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website.

- This multifaceted nature makes accounting a dynamic and rewarding field that extends far beyond the world of numbers.

- Aspiring CPAs are expected to have a bachelor’s degree, more than two years of public accounting work experience, pass all four parts of the CPA exam and meet additional state-specific qualifications if required.

- Accounting is like a powerful machine where you input raw data (figures) and get processed information (financial statements).

- You can choose to manage your business accounting by hiring an in-house accountant or CPA.

Business

Now, let’s compare this to a CPA https://www.instagram.com/bookstime_inc practice or any service business. We’ve done the next best thing to offer you more hours in every day. Accountants have to be very organized and good at calculations. It is a craft that is always in demand, as people always want to manage their finances.

Our partners cannot pay us to guarantee favorable reviews of their products or services. Do not hesitate to contact me at with your practice management questions or about engagements you might not be able to https://www.bookstime.com/ perform. This only is accomplished if the firm leaders are committed to improvements. Yesterday’s methods must have worked quite well to bring you to today but cannot be relied upon to bring you past today into the many tomorrows that will come. It includes music, literature, painting, dance, drama, sculpting, etc. Accounting is one of the most essential skills to becoming an entrepreneur.

What is the difference between a hobby and a business?

FreshBooks accounting software for artists offers a mobile app that allows you to easily connect with your clients and take care of your accounting anywhere – from coffee shop to mountain top. Send invoices on the road, take photos and upload receipts in seconds, and respond to your clients’ questions right from the app. FreshBooks accounting software stays in sync across the desktop accounting art and mobile apps so you can work on whatever device you prefer without missing any important information. Simply enter your expenses and FreshBooks accounting software for artists will digitally store and automatically organize them for you. You’ll know at a glance what you’re spending and how profitable you are, without the headache of spreadsheets or shoeboxes. You can outsource your accounting work to outside professionals who specialize in bookkeeping and tax preparation.

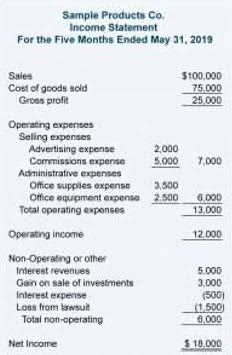

Accurate financial reporting for art holdings is essential for galleries and collectors to maintain transparency and comply with regulatory requirements. This process involves more than just listing assets; it requires a detailed understanding of how to classify and value these assets on financial statements. Artworks can be considered either inventory or long-term investments, depending on the intent behind their acquisition. For galleries, pieces held for sale are typically classified as inventory, while collectors may list their holdings as long-term investments. For a small business, accounting involves tracking money flow in various forms, including operating expenses (e.g., marketing, utilities, rent), cost of goods sold, accounts receivable and sales. It also takes into account liabilities, such as accounts payable, business loans and taxes, and the value of your assets, such as cash and inventory.